This is an old revision of the document!

Table of Contents

Chapter 3.16 - TRAVEL ADVANCE

3.16.010 Travel advance--Approval.

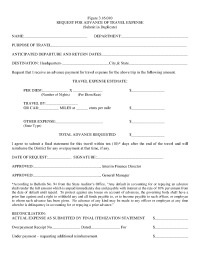

All travel advances for district business by district employees shall be allowable only with and after securing approval of the general manager; provided that travel advances to the general manager and individual commissioners must be approved by the commissioners at a regular or special meeting. All such requests shall be made on the form shown in Figure 3.16.010. (Res. 651 § 2, 2005: Res. 401 § 5, 1984)

Figure 3.16.010.

3.16.020 Return of expense itemization and balance of funds.

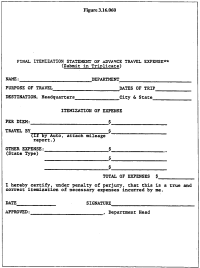

Payment shall be made at the following per diem rate. The per diem rate for all commissioners, officers and employees when traveling for all approved public purposes shall be in accordance with the current IRS per diem travel rates as detailed in IRS Publication 1542. Travel mileage by private automobile shall be paid at the rate allowed by the Internal Revenue Service for business miles, computed by reference to and by use of most direct public highways route to and from the applicable destination. In the event the advance is insufficient to pay the actual expenses, claim may be made therefor by voucher. A report of the expenses incurred shall be made on the form shown in Figure 3.16.020 within ten days of the traveler's return. If the employees, officer or commissioner has attached a lodging receipt to the form, then no other travel receipts are required. (Res. 651 § 3, 2005: Res. 437 § A, 1987: Res. 401 § 6, 1984)

Figure 3.16.020

3.16.030 Return of voucher and balance of funds.

On or before the tenth day following the close of the authorized travel period for which expenses have been advanced, the officer or employee shall submit a return of expense itemization, accompanied by the unexpended portion of such advance, if any. The district shall have a prior lien against and a right to withhold any and all funds payable or to become payable by the district to such officer or employee to whom such advance has been given up to the amount of such advance and interest at the rate of ten percent per annum, after such advance or the balance thereof is due, until such time as repayment or justification has been made. No additional travel advance of any kind shall be made to any officer or employee, at any time when he is delinquent in accounting for or repaying a prior advance. (Res. 401 § 7 (part), 1984)

3.16.040 Nature of advance.

A travel advance made pursuant to this chapter shall be considered as having been made to such officer or employee to be expended by him as an agent of the district for the district's purposes only, and specifically to defray necessary costs while performing his official duties. No such advance shall be considered as a personal loan to such officer or employee, and any expenditure thereof, other than for official business purposes, shall be considered a misappropriation of public funds. (Res. 401 § 7 (part), 1984)